It doesn’t feel like only two weeks have passed since I wrote, “Is it the time to catch the falling knife?”. In that post, I concluded:

Most Likely

Is the bottom done? Possible, but not likely. I’m revising my original hypothesis by a small percentage. Considering how close we are to ticking off many parameters and streaks, there is a good chance that we have a little further downside up to 23500 - 23700 around the -0.5 SD for the 26 W-SMA Bollinger Band.

The only thing that worries me is that I would not like to see the NIFTY sustain for any time below the last swing low of 23896. (Length of time means a short drip for a few days but a quick reversal above that level)

Once this correction is done, then there is a very good chance the upside move is NOT going to be a blast off to newer highs but rather a move that gathers momentum slowly over a period of time (multiple weeks and months).

This move should happen when the momentum indicators correct.

As usual, in the past two weeks, the expected downside of the “Most Likely” scenario has played out. Now it’s time to update the evaluation.

The targets hit so far ….

On the Daily Time Frame

The NIFTY closed below the 200 D-SMA, hitting its time and price targets.

The NIFTY closed below the 200 D-SMA after 401 days, ending the third-longest streak in history (after 402 days in 2020 - 2022 and 416 days in 2004 - 2006).

The NIFTY also completed a 10% correction from the top, ending the week with a 10.6% correction from the highs of 26277.35.

This 10% correction came about after a record 402 days between tw back-to-back 10% corrections. The previous record was 395 days in 2014 - 2016.

The most likely target for the pitchfork revision was also hit.

The chart above shows the pitchfork's target being hit (on the Weekly Time frame) at 0.382 of the mean. As you can see, the only longer single-directional move was a downside move between October 2022 and March 2023.

On the Indicators (refer to the chart below)

The NTW MACD Indicator hit the -3 SD on October 24th and has since created a divergence, i.e., it moved up and has stayed above the low as the NIFTY 50 moved lower. From my last post (Refer next)

On the Time-Weighted MACD SD variant, the indicator hit a value of -3 SD, which is something it has done only 12 times across 27 years of NIFTY history.

80% of the time, the indicator bottom precedes the price bottom by a few days or weeks, and even if there is an intermediate rally, the price tends to make a lower low, creating a divergence on the indicator.

This has now created a temporary bottom (at least).

On MMATI (Multiple Moving Average Time Interaction Indicator), the NIFTY hit a time extreme at the same time and a similar divergence has taken shape.

MMATI or Multiple Moving Average Time Interaction Indicator is a time-based indicator created to identify time extremes. It is ccalculated based on the time between crossover of multiple moving averages normalized into a RSI format i.e. 0 - 100. The Moving Averages are dynamically identified based on the chart time frame. E.g., On the daily time frame, the MAs used are 10 Day - 20 Day and 40 Day SMAs.

The chart above refers to the Daily Time frame showing the Time-Weighted Standardized MACD (Indicator in the first pane) and the Multiple Moving Average Time Interaction Indicator (MMATI) in the 2nd pane below the chart.

The direction agnostic MADI-Z indicator is also reaching a momentum resistance indicating the downside trend can take a breather.

The chart above shows the NIFTY 50 Daily chart with the MADI-Z indicator reaching 70. This is usually a level at which trends tend to pause. Any breakout above 70 would strengthen the downside trend and indicate a potential waterfall decline.

The 40-Day Bollinger Bad Expansion Indicator is also reaching the level of 80, which indicates that the expansion of the bands should come to a halt and contraction of the bands should ensue.

Since 2008, the only times the BBE Indicator has taken out 80 - 82 in a downside move has been in 2011 (European Debt crisis, 2013 (The INR plunge), 2017 (China Devaluation) and 2020 (Covid - 19)

The chart above is the NIFTY 50 Daily chart with the 40-day Bollinger Bands. The indicator below is the Bollinger Band Expansion Indicator for the same time frame.

The mean reversion on Moving Averages is also done

10 D-SMA went below the 20 D-SMA.

The 20 D-SMA went below the 50 D-SMA and the 100 D-SMA.

The 50 D-SMA is now approaching the 100 D-SMA.

The chart above is the NIFTY 50 Daily chart with the 10 Days, 20 Days, 50 Days, 100 Days and 200 Days SMA plotted along with the Pitchfork.

The interesting bit is how extended NIFTY is time-wise on the shorter-term Moving Averages.

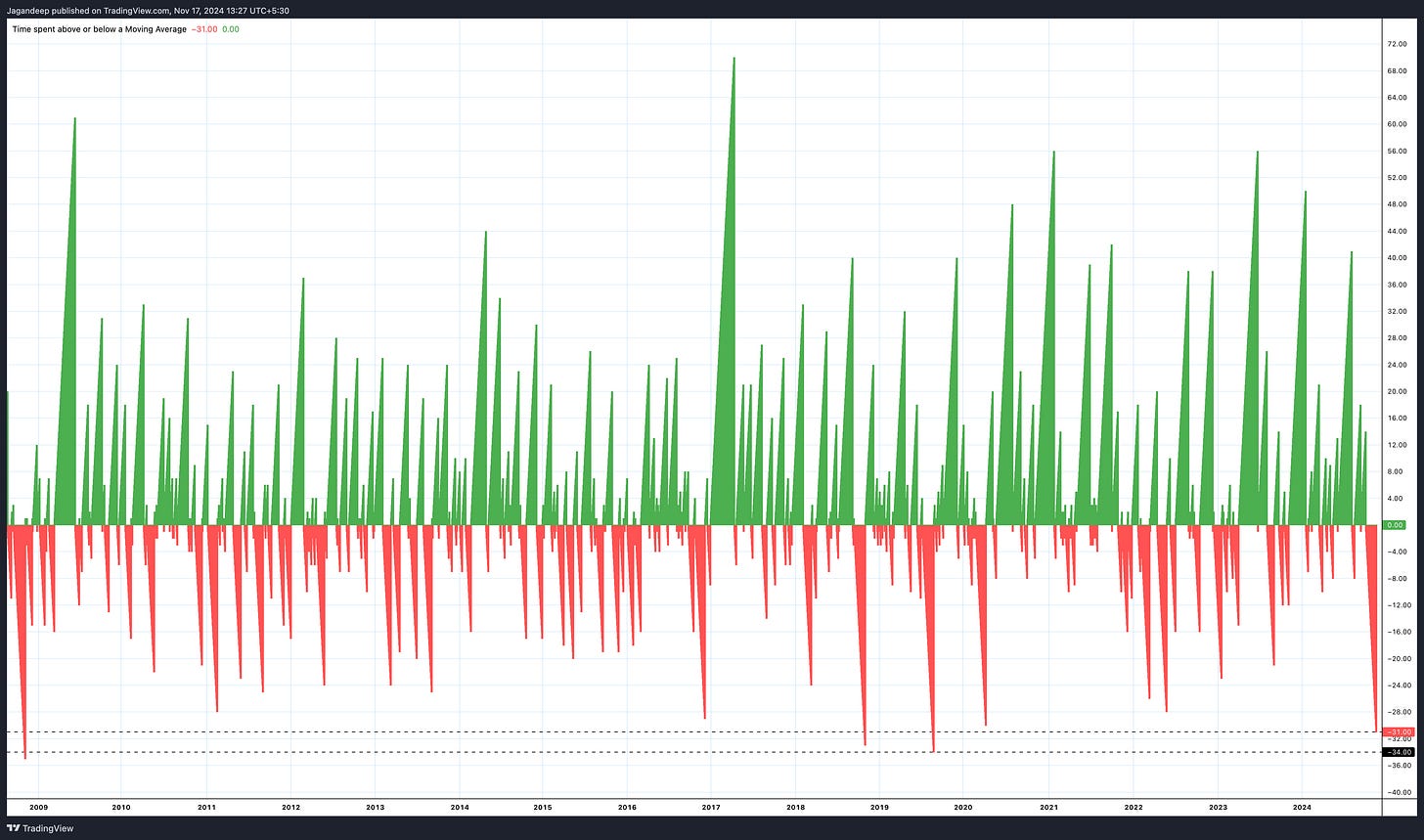

The NIFTY has now spent 31 days below the 20 D-SMA.On the Weekly Time frame. The record since 2009 is 34 days.

The longer streaks beyond 34 days are 35 days (2009) and 41 days (2008), 37 days (2001) and 44 days (1998) [refer chart below)

The chart above visually represents the days spent above (green) or below (red) the 20 D-SMA since 2009.

The 10 D-SMA has now spent 26 days below the 20 D-SMA. Remember » For a Moving Average to cross another, the price needs to move above (ideally) the higher moving average and sustain for a little while, or at least move closer to the higher moving average.

In almost all instances (except 3) since 2009, this streak has ended between 35 - 40 days. (Refer the chart below)

The chart above visually represents the time the 10 D-SMA has spent above (green) or below (red) the 20 D-SMA since 2009.

On the Weekly Time Frame

The momentum indicators on time and price have come down, but they are still in fairly decent shape as they’re in a consolidation zone (Refer the chart below)

The chart above is the NIFTY 50 Weekly chart with the Normalized Time-Weighted MACD (first indicator pane), the MADI-Z (the second indicator pane) and the Multiple MA Time Interaction Indicator (MMATI) (3rd indicator pane).

Bollinger Bands >

The 26-week Bollinger Bands and the 52-week Bollinger Bads both indicate that these bands should continue contracting for the foreseeable future, i.e., the markets should not expect to see a fast and quick trend in either direction.

The price has also tested and closed below -1 SD on the Weekly Time-Frame for the 26-Week Bollinger Bands.

The chart above is the NIFTY 50 Weekly chart with the 26-week and the 52-week Bollinger Bands. The primary chart has the 26-Week Bollinger Bands.

Moving Average Analysis

The NIFTY is on the verge of testing its 50 W-SMA (currently at 23250) and rising at approx. 75 points per week.

The 13 W-SMA has been above the 26 W-SMA for 77 weeks and has still not successfully reverted (although there is time here)

This is the fourth-longest streak in history.

The longer streaks are 79 weeks, 80 weeks, and 94 weeks.

On the Monthly time Frame ….

From my previous post

I’ve been talking about the streak of Higher Highs on the Monthly Time Frame for the NIFTY. This streak ended in October after 11 consecutive months of Higher Highs. Refer below for the extract from my last post, “Marching to the Beat into the Valley of Death.”

This is just one example of how things can go, whenever this streak of higher highs breaks.

September will - most likely - be the 11th consecutive Higher High on the Monthly charts. The only higher streaks have been

11 months in 2015 - 16

12 months in 2005 - 06

13 months in 2017 - 18

Now, if we step back and look at what happened in prior instances where the NIFTY had a streak of >=8 months with consecutive higher highs, then this is the data

2018 was followed by a 30-month consolidation that ended with a 30%+ correction in March 2020.

A 30%+ correction followed the 2006 streak in two months.

The 2015-16 streak was followed by a 26% fall over 12+ months.

The three instances with streaks of 8 consecutive higher highs all had follow-up corrections of between 12.2% and 14.8%

This is one streak that suggests that maybe a 1% - 2% correction is still pending, but a 10.62% correction is in the ballpark, and 3 data points aren’t necessarily enough to make a definitive statistical conclusion on what the expected % decline should be.

Conclusions from the current analysis

To conclude, the following need to be considered:

On the daily time frame

Most downside targets ( at least initial ones) have been met.

The shorter-term moving average time indicators indicate extremes.

The time and price indicators suggest an exhaustion of the downside trend.

The mean-reversion indicators are starting to reach an expansion extreme.

Most Likely

The last 1% - 2% are almost impossible to predict, but nevertheless

The correction is most likely done ( at least this round).

The NIFTY should move closer to or, ideally, higher than the 20 D-SMA (at 24246 and falling at 60 points per day) within the next 5 - 10 trading days.

The 10 D-SMA should move above the 20 D-SMA within the next 15 - 20 trading days.

The ideal target to the upside is at least 24800 - 25200.

A move beyond 25200 would mark the end of this correction,, whereas if the NIFTY doesn’t reach approximately 24800, then it will be significantly bearish, in my opinion.

Once this target is done, I’d expect another significant pull-back to the current lows (higher or lower lows are possible).

At this point, the seeds of the next ATH will be sown. In my opinion, the market should see a substantial ATH only in Q1 CY 2025.

Less Likely

The market breaks below 23200 - 23000 and heads to 22000 or even 20000.

Approx. 23000 is the line in the sand for me.

Any sustained momentum below 23000 would mean taking out everything and sitting on the sidelines.

I have no idea what would cause this, but it would have to be a global black swan.

The analysis is meant to be foremost a journal of my analysis. Consider it as such and use it for your analysis. I’m not a SEBI-certified market analyst. I also post-market analysis on Threads, BlueSky and Twitter with the handle @SeldonOnMarkets