This is a dicey week for writing a market predictions blog, but I’m going to try my hand nonetheless. It is arguably the one week with the most consequential macro events for the global markets, including the US Presidential elections, the FED meeting, the Chinese NPC Standing Committee, etc.

The Story of October 2024

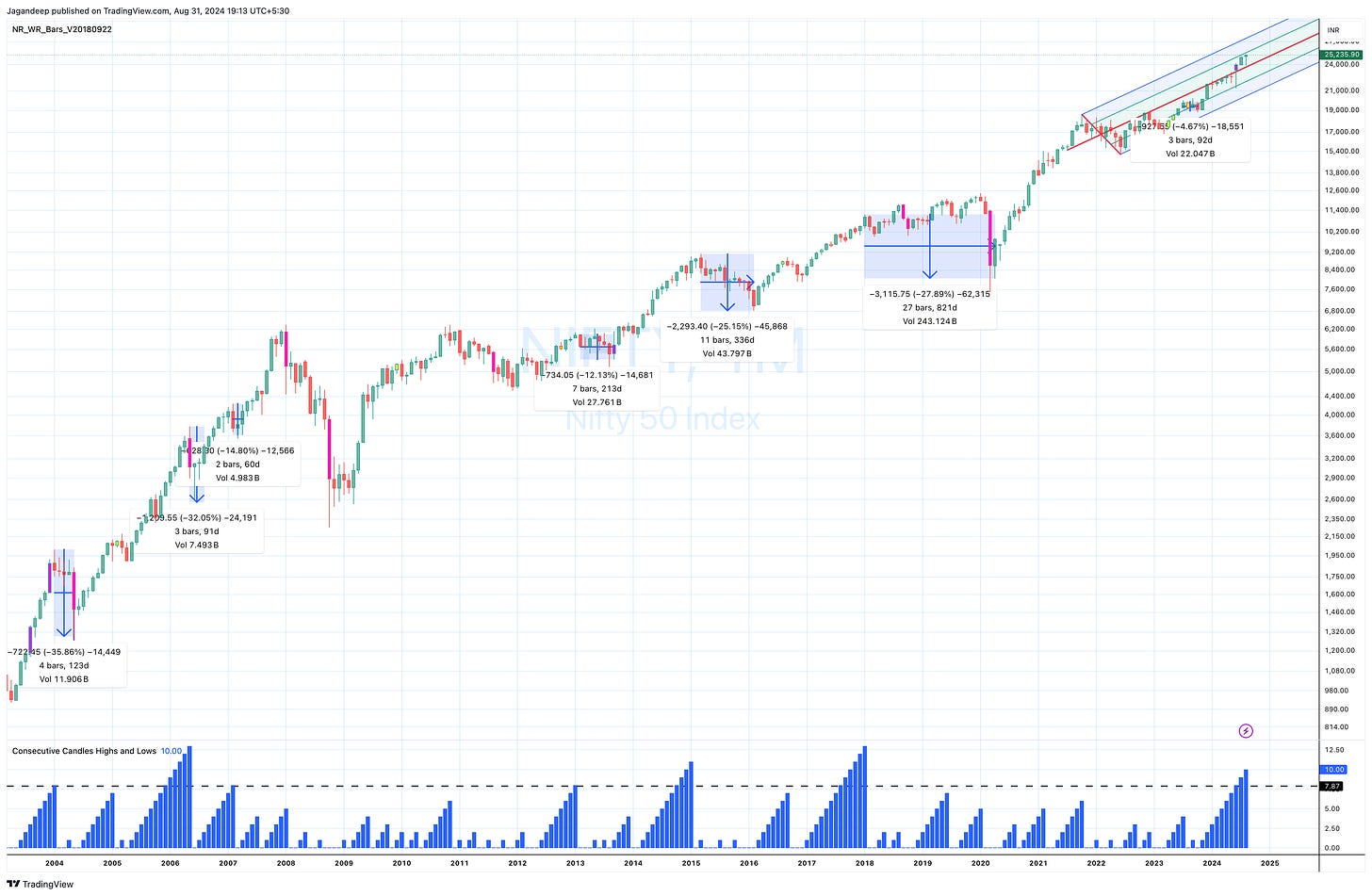

October 2024 was a simple story. It was a story of reversion to the mean and of an expected correction playing out.

Every week of October has seen a red candle except the last one, which was saved by the Muhurat session.

The Correction Stats

The NIFTY 50 Index was down 8.4% - at its lows - from its all-time high, the NIFTY Midcap is down 10%, and the smallcap index is down 13%.

The NIFTY 50 Equal Weight index was down 10.17% at its lows, and the NIFTY 100 Equal Weight was down 10.81% at its lows.

This implies the majority of the stocks have fallen more than what the NIFTY appears to denote, and the average portfolios have probably seen the first major drawdown in a while.

Most importantly, this market has not reversed back in a “V” as the participants have recently become used to.

From a flows perspective,

The FIIs took out approx. 88K Crore from the secondary markets.

The Hyundai IPO was essentially a dud, and the next major IPO (Swiggy) is coming at a 50%+ discount to its listed peer (Zomato). It's fair to say the IPO momentum and euphoria have taken a significant hit.

The NIFTY has hit the 26W-SMA, a level it has not sustainably broken since December 2022.

The NIFTY has also corrected back to the -0.25X of the Pitchfork (I’ve been tracking this Pitchfork for quarters). The range between the -0.25X to the middle line of the pitchfork is where the NIFTY has consolidated during the first half of this CY. (Refer to the chart below)

On the Daily Time frame, the correction did run into some support around 24500 - 24700, but after a small pullback, the NIFTY corrected down to 24073.

The last swing low for the NIFTY was 23894, and in bull markets indices don’t break swing lows.

Follow-Up - The anatomy of the correction (as predicted) ….

The NIFTY stopped tagging the 26W Bollinger Band,

The ensuing correction took support at the 10W-SMA and then

Failed to sustain a tag of the 26W-SMA successfully, and has since then

Corrected back down to the 26W-SMA.

The remaining post will try to answer the big question: Which of the following three scenarios plays out here?

The NIFTY breaks and starts to sustain below the 26 W-SMA or

We see a substantial pullback (even a double-top), a dump, and the start of a bear market. or

A move back to the newer highs and onwards?

This is where the weakness can be translated from the daily to the weekly time frame (essential for a significantly significant correction).

The Analysis

Daily Time-Frame

The price has stabilized below all the major Daily Simple Moving Averages except for the 200 D-SMA, which is approximately 3% away from the current lows (23450 and rising).

Refer the chart of the Pitchfork below; if we assume this upthrust started from the lows in June 2022 then since then the NIFTY has not corrected more than two PF bands i.e., the correction from November 2022 to March 2023 which was ~12.25%

Bollinger Band Analysis

One of the things I do is utilize the Bollinger Bands across multiple periods (after all, they’re essentially just price and Standard Deviations). On the Daily time frame, I use 20 days (one trading month) and 40 days (two trading months) [Refer to the charts below]

On the 20-Day Bollinger band, there is still some space for the market to contract, whereas,

On the 40-Day Bollinger Band, the expansion cycle seems to have been completed and indicates a contraction of the bands is coming up.

In the chart above, the Core chart has multiple Bollinger Bands with a 40 D-SMA at its core, and the two custom indicators below are for 20 Days and 40 days, respectively.

Point to Note (from my last post) - This streak is now done.

This is now the 2nd longest streak, at 230 days, for the NIFTY between consecutive tags of the -2 Standard Deviation (40 days), The only longer streak is 453 days.

Momentum Indicators:

The good news is that, as you can see on both the custom indicators, the downside momentum has stalled.

On the Time-Weighted MACD SD variant, the indicator hit a value of -3 SD, which is something it has done only 12 times across 27 years of NIFTY history.

80% of the time, the indicator bottom precedes the price bottom by a few days or weeks, and even if there is an intermediate rally, the price tends to make a lower low, creating a divergence on the indicator.

This has now created a temporary bottom (at least).

The MADi-Z is equally interesting because this indicator tends to create bottoms during consolidations and moves higher when the market trends. At this point, this indicates a weakish downtrend is in progress. If it starts to cross the middle line, the quality of the trend will improve.

The first indicator above is the time-weighted normalized MACD expressed in a Standard Deviation format, and the second indicator is the MADi-Z.

Moving Average Analysis

One way to determine price and time extremes is to evaluate how moving averages behave relative to each other.

Below is a quote from my last post. The 20 D-SMA closed below the 50 D-SMA after a record 224 days (the previous record was 223 days)

During the last correction, the 10 D-SMA completed its pullback to, and below, the 20 D-SMA.

It has now been 211 days since the 20 D-SMA went and closed below the 50 D-SMA. The all-time record is 223 days.

Now, if this cycle has to be completed, then that means the NIFTY won’t make a major upside move for at least multiple weeks.

The NIFTY could either consolidate for a while (multiple weeks) OR even correct lower at pace (so that the Moving Averages get pulled together).

On Monday, the 20 D-SMA will also cross below the 100 D-SMA, completing another cycle for the short-term moving average.

The Medium-term cycle still has time, as the 50 D-SMA has been above the 200 D-SMA for 355 days. The points of concern really occur when this is between 420 and 450 days, i.e., this cycle could easily continue for anywhere between 4 and 7 months.

The NIFTY has now spent 393 days above its 200 D-SMA. The only two longer instances are 401 days (2020 to 2021) and 414 days (2004 to 2006). Given that we’re only 2.5% away from the 200 D-SMA, there is a very high probability that we will hit it in this correction.

Weekly Time frame

This is the time frame to watch because the big question is whether the weakness on the Daily time frame is starting to translate into this time frame.

Bollinger Bands > The 26-week Bollinger Bands and the 52-week Bollinger Bads both indicate that these bands should continue contracting for the foreseeable future i.e, the markets should not expect to see a fast and quick trend in either direction.

Moving Average Analysis > The 13 W-SMA has been above the 26 W-SMA for 75 weeks. This is the fourth-longest streak in history. The longer streaks are 79 weeks, 80 weeks, and 94 weeks. This is something to keep an eye on.

The momentum indicators of MADI-Z, PVMO, and NTW-MACD have also pulled back substantially and are now starting to reach a pit stop, if not a full stop, on the downside. There is a risk here that these indicators gather momentum, and if that happens, we can see a significant fall in the indices, but it is hard to imagine that happening without a major assist from the global markets.

Updated from previous 3 Posts » The Impending & Overdue Correction

The “Overdue” nature of these corrections is now getting worse:

83 weeks since the last 10% correction ended. The only longer streak is 86 weeks. » There is a very high chance that this streak ends in this correction.

121 weeks since the last 15% correction ended. The only longer streak is 197 weeks.

228 weeks since the last 20% correction ended. This is a record.

231 weeks since the last 25% correction ended. This is also a record.

The larger Time Frames - Monthly

The NIFTY is still fine in the monthly time frames. The momentum indicators are starting to reach near extremes and can continue. Refer to the chart below.

I’ve been talking about the streak of Higher Highs on the Monthly Time Frame for the NIFTY. This streak ended in October after 11 consecutive months of Higher Highs. Refer below for the extract from my last post, “Marching to the Beat into the Valley of Death.”

This is just one example of how things can go, whenever this streak of higher highs breaks.

September will - most likely - be the 11th consecutive Higher High on the Monthly charts. The only higher streaks have been

11 months in 2015 - 16

12 months in 2005 - 06

13 months in 2017 - 18

Now, if we step back and look at what happened in prior instances where the NIFTY had a streak of >=8 months with consecutive higher highs, then this is the data

2018 was followed by a 30-month consolidation that ended with a 30%+ correction in March 2020.

A 30%+ correction followed the 2006 streak in two months.

The 2015-16 streak was followed by a 26% fall over 12+ months.

The three instances with streaks of 8 consecutive higher highs all had follow-up corrections of between 12.2% and 14.8%

Chart for reference. We’ll be lucky to escape with a 12%ish correction.

Conclusions from the Last Post - It worked.

The NIFTY targets are done for this rally (25500 - 27000), and we ended up with a current high of 26277 (right in the middle of the range)

Most Likely

This NIFTY correction should take support in the range of 24450 - 24700 (and in a worst-case scenario near 24K)

The next upmove will not be easy, and there is a very good chance that the NIFTY sees either a double-top or a momentum-less newer high. This doesn't mean that the NIFTY can’t get into the 27Ks or even the 28Ks, but that the move will now be easy. Why? This move should happen when the momentum indicators correct.

From a timing perspective, the next upmove should take some time i.e., there is a good chance that the NIFTY takes some time to sort itself out here (allowing moving averages to catch up and play out their reversions).

Less Likely

An upmove that is as fast as this fall and takes out 26277 with significant momentum.

In this market, it is hard to rule something like this out, but it will either need stellar numbers or a major breakthrough in any of the wards (i.e., news).

Least Likely

There is a break below the 26 W-SMA with momentum and a 15% correction here.

The only way I see this happening IF the war between Israel and Iran truly engulfs the Middle East or something other equally bad happens (in terms of a black swan)

Conclusions from the current analysis

Most Likely

Is the bottom done? Possible, but not likely. I’m revising my original hypothesis by a small percentage. Considering how close we are to ticking off many parameters and streaks, there is a good chance that we have a little further downside up to 23500 - 23700 around the -0.5 SD for the 26 W-SMA Bollinger Band.

The only thing that worries me is that I would not like to see the NIFTY sustain for any time below the last swing low of 23896. (Length of time means a short drip for a few days but a quick reversal above that level)

Once this correction is done, then there is a very good chance the upside move is NOT going to be a blast off to newer highs but rather a move that gathers momentum slowly over a period of time (multiple weeks and months).

This move should happen when the momentum indicators correct.

Less Likely - Either of the two scenarios

The bottom is already done. OR

After the next low, we get an upmove that is fast and furious, taking out the current All-Time-Highs (ATH).

In this market, it is hard to rule something like this out, but the only way I see this happening is with major positive news about the Indian economy or the wars.

Least Likely

The 26-week Bollinger Bands (currently at 23800) have sustained a break below the -0.5 SD, indicating a 15% correction.

The only way I see this happening is IF the war between Israel and Iran truly engulfs the Middle East or something equally bad happens (in terms of a black swan)

The analysis is meant to be foremost a journal of my analysis. Consider it as such and use it for your analysis. I’m not a SEBI-certified market analyst. I also post market analysis on Twitter with the handle @SeldonOnMarkets